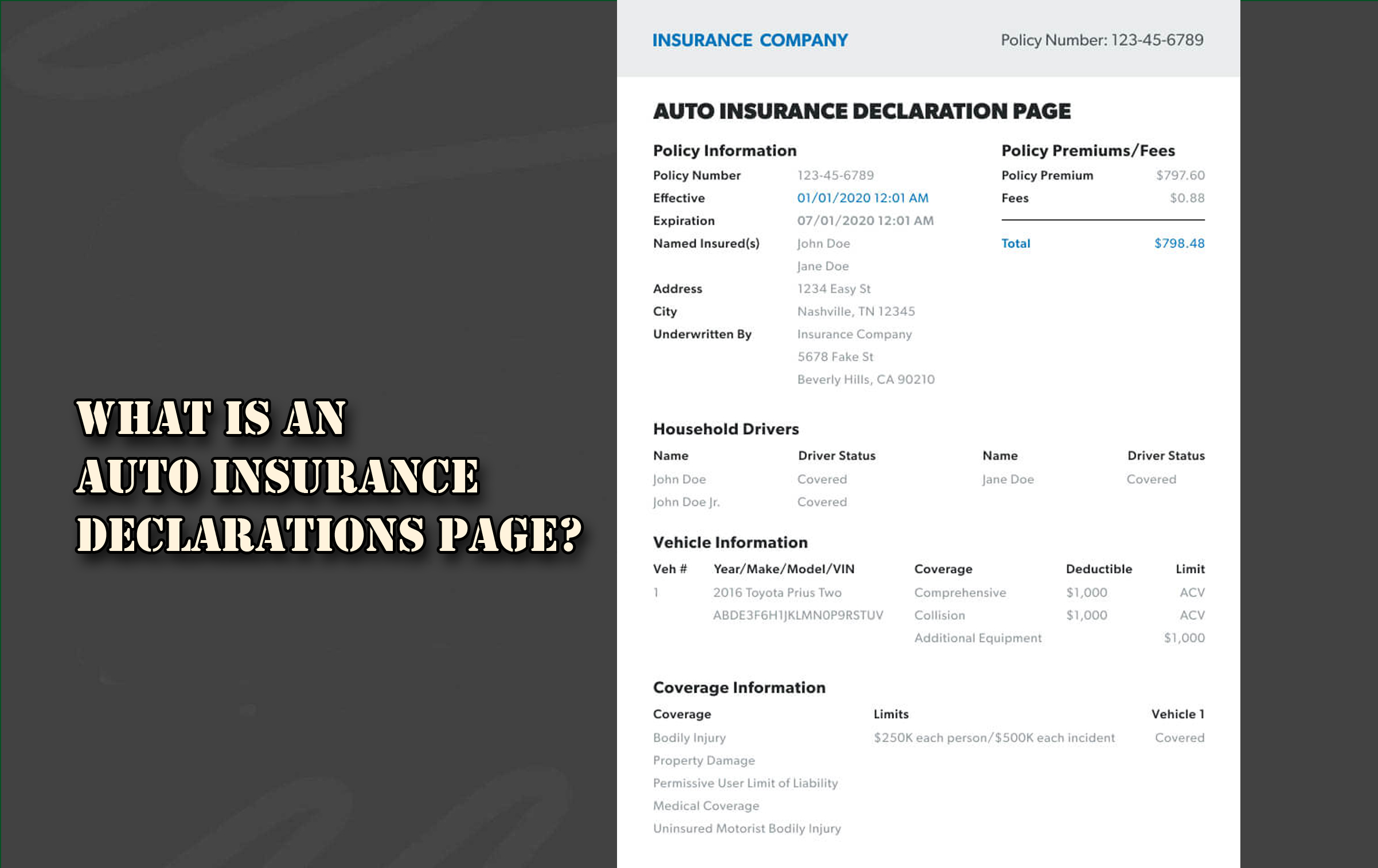

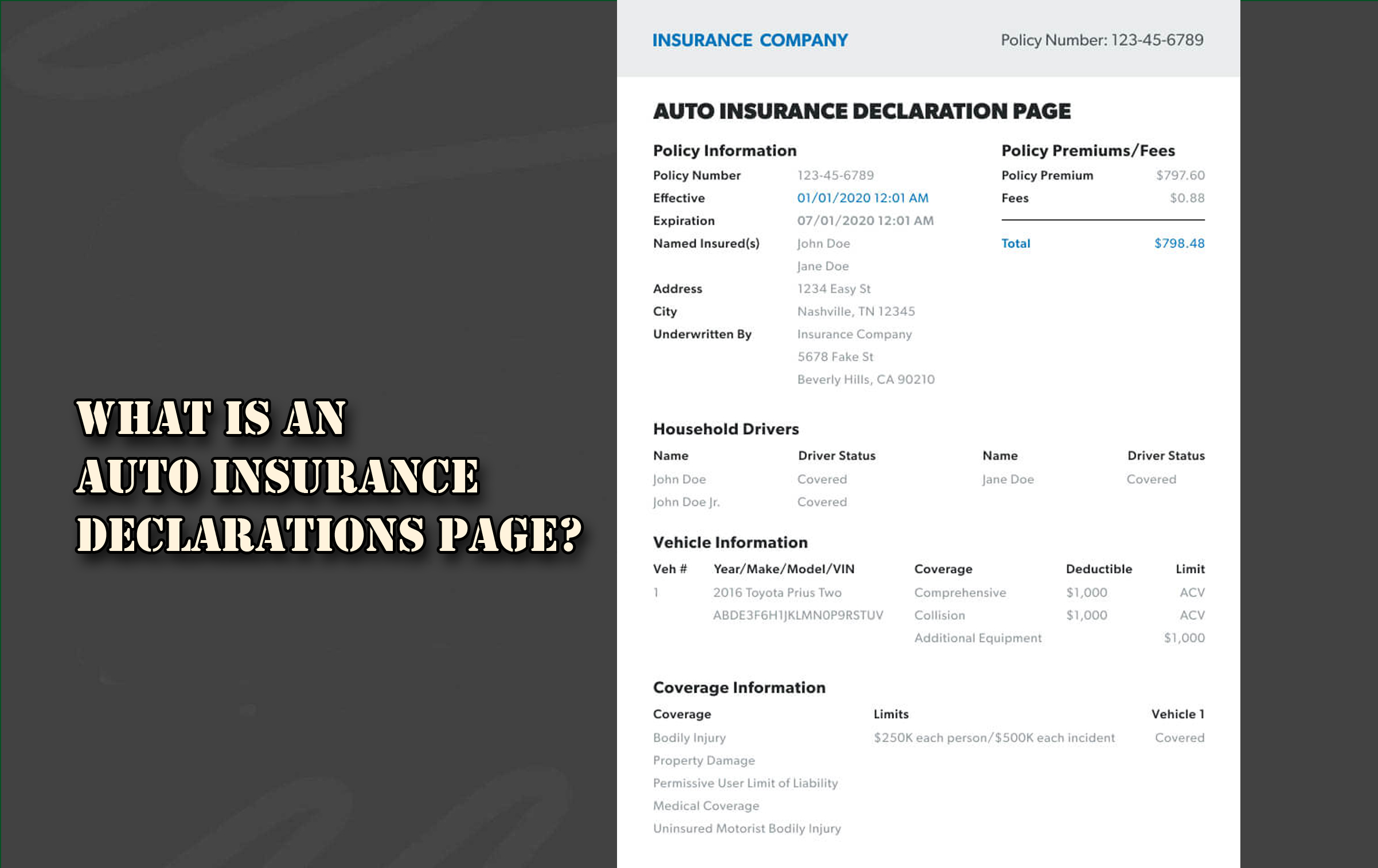

What is an auto insurance declarations page? When you purchase auto insurance, you will receive a document known as the declarations page.

This component of your policy provides a snapshot of your coverage, offering a quick and comprehensive overview of the most critical details.

Whether you’re a first-time policyholder or a seasoned driver, understanding the declarations page is crucial for ensuring you have the right coverage for your needs.

Now, while the term “declarations page” might sound technical, its purpose is straightforward: to declare the specific details of your insurance policy. It is a vital document that empowers you to understand and manage your insurance policy effectively

What Is An Auto Insurance Declarations Page?

The auto insurance declarations page is a summary document provided by your insurance company that outlines the key details of your policy.

Also abbreviated as the “dec page,” this document serves as a quick reference guide, where it details who and what is covered, the limits of coverage, and the associated costs.

It is usually the first page of your policy packet and acts as a roadmap for understanding the finer details of your coverage.

Key Information Included

The more essential value of information included on this ‘dec page’ are:

- Policyholder Information: The names and addresses of the individuals covered under the policy.

- Premium Costs: The amount you’re paying for coverage, broken down by type if applicable

- Effective Dates: The start and end dates of your coverage period.

- Vehicle Information: Details about the insured vehicles, including make, model, and VIN (Vehicle Identification Number).

- Policy Number: A unique identifier for your insurance policy.

- Coverage Details: Specifics about the types of coverage included (e.g., liability, collision, comprehensive) and their limits.

Components Of An Auto Insurance Declarations Page

As mentioned, some components exist on the insurance declarations page that contain vital information about the policyholder. Listed below are some of the known components of this page:

Policyholder Information

This section includes the full name and contact information of the primary insured individual and any additional insured drivers. It’s important to verify that all names and addresses are accurate to avoid any complications in the event of a claim.

Coverage Types And Limits

Coverage types and limits are the core of the declarations page. These details outline the protections you have, such as:

- Liability Coverage: Protects you against claims from others for bodily injury or property damage caused by an accident you’re at fault for.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re in an accident with a driver who has inadequate or no insurance.

- Comprehensive Coverage: Covers non-collision-related damages, such as theft, vandalism, or natural disasters.

- Collision Coverage: Covers damage to your vehicle resulting from a collision, regardless of fault.

Deductibles And Premiums

This section specifies the deductible amounts you’ll need to pay out-of-pocket before your insurance kicks in for claims under collision or comprehensive coverage. Premiums, the cost of your policy, are broken down for transparency. Hence, it allows you to see where your money is going.

Discounts And Endorsements

If you’ve qualified for any discounts—such as for safe driving, bundling policies, or installing anti-theft devices—these will be listed on the declarations page. Additionally, endorsements or riders, which are modifications to your standard policy, will also appear here.

Why The Declarations Page Matters

Here are some of the reasons why the Declarations page matters they are listed below:

Easy Reference For Coverage Details

The declarations page simplifies the process of understanding your policy by minimizing essential information into a single document. Additionally, this is particularly helpful when you need to confirm coverage types or limits quickly.

Proof Of Insurance

Many situations require proof of insurance, such as registering a vehicle or obtaining a loan. The declarations page serves as an official document that satisfies these requirements.

Facilitating Claims

In the unfortunate event of an accident, the declarations page can expedite the claims process by providing quick access to essential details about your policy, including coverage limits and deductibles.

How To Use Your Declarations Page Effectively

These are the following ways that you can make use of your declarations page with effective measures:

Verify The Information

Always review your declarations page upon receiving it to ensure all details are accurate. Any errors, such as incorrect vehicle information or misspelled names, should be reported to your insurance provider immediately.

Compare Policies

If you’re shopping for insurance, the declarations page is a vital tool for comparing coverage options and costs between providers. Moreover, it highlights the specifics of what each policy offers, enabling informed decisions.

Keep It Accessible

You can store your declarations page in a safe yet accessible location, such as a digital file or a dedicated folder. This ensures you can retrieve it quickly when needed.

Frequently Asked Questions

How Is The Declarations Page Different From The Full Insurance Policy?

The declarations page is a summary document that highlights the most critical aspects of your policy. The full insurance policy, on the other hand, contains comprehensive details, including terms, conditions, and exclusions.

Do I Need To Carry My Declaration Page In My Car?

While it’s not typically required to carry your declarations page, you should keep a copy of your insurance ID card in your vehicle. The declarations page is more useful for home reference or in situations requiring detailed proof of coverage.

What Should I Do If I Lose My Declarations Page?

Contact your insurance provider to request a new copy. Most companies offer digital access to policy documents through online portals or mobile apps.

Can The Information On The Declarations Page Change?

Yes, the declarations page can change if you update your policy, such as adding a vehicle, modifying coverage limits, or qualifying for new discounts. Always request an updated declarations page after making changes.