Zable personal loan – In life, there will always be unexpected financial needs that will bamboozle your life when you least expect it.

When these needs arise, a personal loan can be a great option to cover expenses like medical bills, home renovations, debt consolidation, or even a significant purchase.

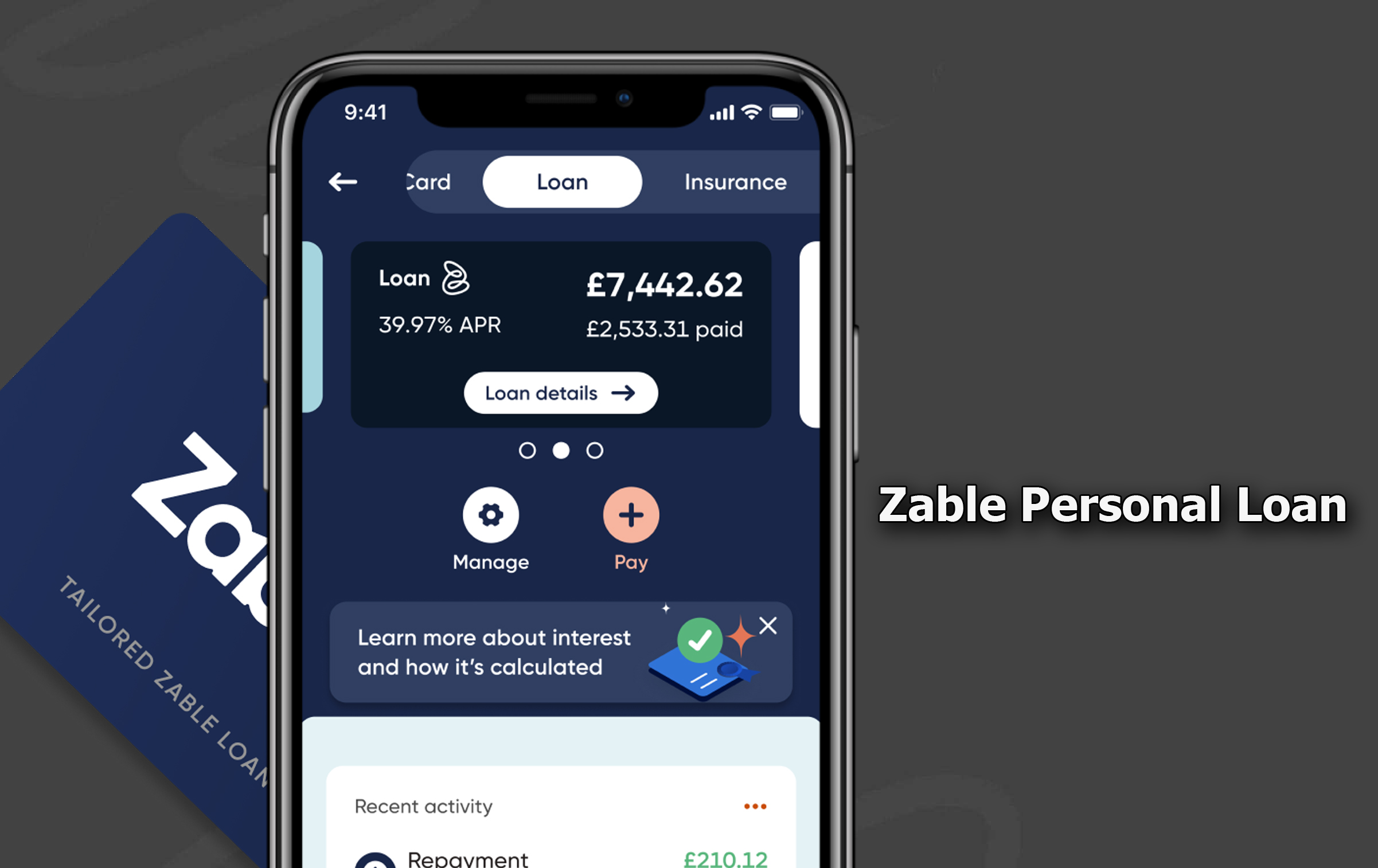

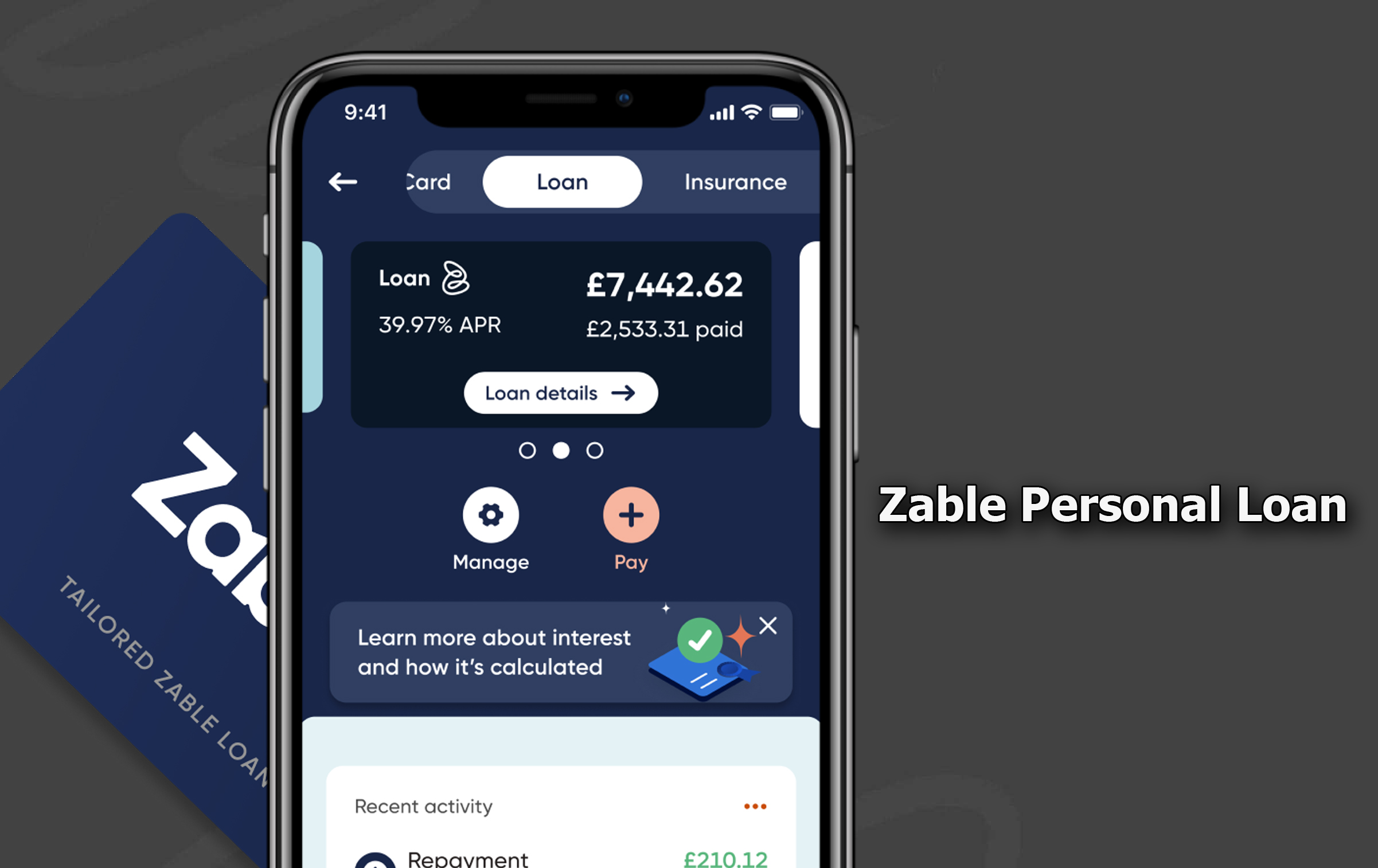

Zable, a well-known online lender, offers personal loans designed to provide quick and accessible funding to individuals who need financial assistance.

With competitive rates and a streamlined application process, Zable personal loans have become a popular choice for borrowers who seek convenience and reliability.

Furthermore, Zable has flexible loan options, which allows borrowers to access funds without extensive paperwork or long waiting periods.

Whether you have excellent credit or are working on rebuilding your credit score, Zable provides a straightforward loan approval process that caters to different financial situations.

Features Of Zable Personal Loan

Numerous loan features comes with Zable personal loans and it all makes them an attractive option for borrowers. These features are designed to provide flexibility, affordability, and ease of access to financial assistance. They include:

- Interest Rates: Firstly, the interest rates on their loans are competitive, often determined by the borrower’s creditworthiness. Also, borrowers who have really good credit scores typically receive lower rates.

- Loan Amounts: Zable offers personal loans that range from a few hundred to several thousand dollars. Moreover, it all depends on the borrower’s credit profile and financial history.

- Repayment Terms: This loan provider also offers flexible repayment terms, allowing borrowers to choose a plan that fits their financial situation.

- Fast Approval and Funding: One of the best highlights of Zable personal loans is the quick approval process. Once approved, the funds are quickly disbursed within a short period.

- No Hidden Fees: Zable is very transparent with its fees, and it ensures that borrowers know what to expect without unexpected costs.

Eligibility Requirements

Before you apply for a Zable personal loan, it’s important to first understand the eligibility criteria. Zable ensures that its loans are accessible to a wide range of borrowers but there are still specific requirements that must be met. They are:

- Age Requirement: Applicants must be at least 18 years old.

- Bank Account: A valid bank account is required for loan disbursement and repayment.

- Income Verification: Borrowers must provide proof of a stable income to demonstrate their ability to repay the loan.

- Credit Score: While Zable considers applicants with various credit scores, having a good credit score increases the chances of approval and lower interest rates.

- Residency Status: Also, the applicants must be legal residents of the country where Zable operates.

Benefits Of Zable Personal Loan

There are several advantages to choosing Zable personal loans, making them a preferred option for many borrowers. These benefits are:

- The entire process can be completed online without visiting a physical branch.

- Zable ensures there are no hidden costs or unnecessary charges.

- Zable personal loans are unsecured, which means that borrowers do not need to provide assets as collateral.

- Borrowers can receive funds quickly, often within a few hours or the next business day.

- Borrowers have the option to choose repayment plans that suit their financial needs.

Drawbacks Of Zable Personal Loan

Despite its numerous advantages, there are also some drawbacks to consider when applying for a Zable personal loan. They include:

- Higher Interest Rates for Poor Credit: Borrowers with lower credit scores may face higher interest rates compared to those with excellent credit.

- Potential Fees for Late Payments: Borrowers must ensure they make timely payments to avoid late fees.

- Limited Availability: Zable personal loans may not be available in all states or regions.

How To Apply For A Zable Personal Loan

The process of applying for a Zable personal loan is pretty simple and straightforward. What’s more, the application can be completed online, and borrowers can receive quick responses regarding their loan approval status.

If you want to take out a personal loan from Zable, here’s what you need to do:

- Start by visiting the official Zable website

- Next, you navigate your cursor to the personal loan section and click to launch it

- Proceed to fill out the application form with personal details, financial information, and loan requirements.

- Next, you must provide any necessary documents, such as proof of income, identification, and bank account details.

- If you are eligible, Zable will present a loan offer with details on loan amount, interest rate, and repayment terms.

- Accept the offer that best suits you

- Once the offer is accepted, funds are disbursed to the borrower’s bank account within a short timeframe.

Frequently Asked Questions

What Credit Score Is Needed To Qualify For A Zable Personal Loan?

Zable considers applicants with different credit scores, but a higher credit score improves the chances of approval and securing lower interest rates.

Can I Pay Off My Zable Personal Loan Early?

Yes, Zable allows borrowers to repay their loans early without penalties. This helps them save more on interest costs.

Can I Get A Zable Personal Loan With A Low Income?

While Zable requires proof of income, the eligibility decision depends on various factors, including credit history and debt-to-income ratio.